Screwball

-

Posts

546 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Posts posted by Screwball

-

-

4 minutes ago, 1984Echoes said:

And living paycheck-to-paycheck is exactly what SB has outlined here.

An inability to budget, to "live within ones' means", to avoid "splurge" shopping, to rely on credit cards or relatives to help one "maintain a lifestyle"... all lead to the same problem:

No budgeting/ restraint = living paycheck-to-paycheck = no money = no savings.

Spending cash/credit has been embedded in our culture due to advertising and cheap/easy credit. I remember people bouncing checks. They would come in to pay for the check - and the $30 dollar fee along with it - and not bat an eye. It was worth the extra 30 to have fun for one night knowing the check was going to bounce.

Nuts!

It's all about consumption - the more the better. We are a shopping mall with a flag.

-

You don't need a financial advisor to keep a budget. Maybe I'm too old, but you don't buy "splurge" items when you don't have the money to pay for them. I saw this with my kids, and I hear it from other parents. This is the "I want it now" mentality we see in TV commercials.

The younger people just don't seem to be very good with money/credit. Or maybe numbers in general, as I see in my classes. Many of these younger people can't make change, balance a checkbook, and some struggle with basic math.

Their parents and educational system has failed them IMO. And of course easy and cheap (not so much anymore) credit is also a culprit. This is not a good picture going forward for many I suspect.

-

This part kind of stuck out to me;

Some have zero emergency savings, but know more about managing their finances than an advisor, and look to social media for advice.

Maybe that isn't such a good idea?

-

1 hour ago, Tiger337 said:

"You guys?" I hope I am not included in that as I never mentioned politics at all!

Noted and I stand corrected.

-

That survey had absolutely nothing to do with politics. I honestly don't know how you guys get that stuff from it. I thought is was some good insight into the current human thought and culture, but I guess it all has to be tribal these days.

-

1

1

-

-

I don't know where to put this, but I found it really interesting. I don't think it really fits with investing, so I didn't want to put it there.

This is a survey published by Prudential Insurance. ****Warning; the link goes to their webpage, which only shows part of the survey - then you have to download the rest. **** It's 5 pages of mostly graphs and opens in another tab for me using FF.

Generational Gap Grows: Work & Money Outlook Divided (Fact Sheet)

-

53 minutes ago, Deleterious said:

This person collected links to the major banks economic and investing forecast for 2023.

https://serebrisky.com/2022/12/29/economic-and-investment-outlook-for-2023-by-top-investment-banks/

I skimmed the one from Goldman. I'm familiar with the Jan lady who is their lead (sell side - get to that shortly). They covered their ass by saying so many things are dependent on how other things go down. I think that is accurate.

The market doesn't like uncertainty, and there is so many volatile things going on.

***

But what's the "buy side" up to?

Wall Street’s Big Banks Score $1 Trillion of Profit in a Decade - Bloomberg

Decade? 2012-2013 ish, after we bailed their criminal asses out in 2009. They've been off to filthy rich lollipop land ever since.

I liked this part at the end;

QuoteDisclosure Appendix

Reg AC

We, Jan Hatzius, Daan Struyven, Yulia Zhestkova and Devesh Kodnani, hereby certify that all of the views expressed in this report accurately reflect our personal views, which have not been influenced by considerations of the firm’s business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs’ Global Investment Research divisionBold mine. That's the Chinese Wall, one way they use to cheat, and always have.

Blue Horseshoe loves Anacott Steel.

-

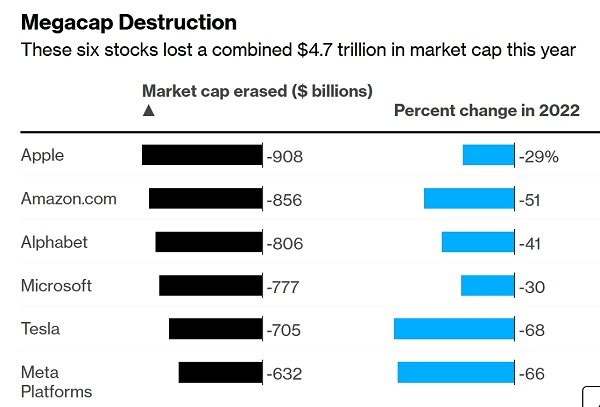

Retail Investors Took a Beating in 2022. Will It Continue in 2023? - Bloomberg

A visual to go along with the data in posts above.

Broken down by the 11 Sectors. I can't fit all the industries, but you can see a similar chart here at Finviz

This is based on the following;

QuoteThe framework created by the Global Industry Classification Standard (GICS) has four tiers that break companies into 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries.

-

-

10 minutes ago, oblong said:

Every two years I have a new “system” to learn culturally. Then I have to fit my job to that for reviews. I agree totally it’s bullshit.

here you go

<snip>

OMG, don't get me started on reviews. Ok, you did...

We had guys who spent countless hours spewing bullshit upstream (in their review - they talked about it - so wild - it was like their entire year) - which was part of the deal. We called them PMP's - personal management profile - attached with a laundry list of "accomplishments", "training time", "goodwill" and all the current corporate bullshit buzzwords of the day you had to prove you met to get some shitty raise, if any at all.

And at the end of the day, that feeds into mayhem on the manufacturing side. Some ladder climbing bullshit artist gets promotions and raises because he promised a new fan-dangled thing on a product, while in reality is was a total bust and cost the company millions.

Us foot solders told them so years before but we were the ones full of shit.

-

1

1

-

-

23 minutes ago, oblong said:

My sticking point is the why. It’s not to lay people off and be mean or because people are sitting home being lazy after getting a few thousand dollars in 2020. It’s because either the work doesn’t justify the cost to attract people for the product or service being sold. It’s also because there’s fewer people around to fill the slots.

I don’t like to talk specifically about my employer but we went thru a huge massive layoff in august. Then at the end of the year a bunch of others retired due to pension interest rate changes. Im now doing my old boss’s job, as if relates to my world. We are all scrambling. Work went to “low cost” countries. It sucks. Our customers will suffer. Im not speaking from a position of senior management but simply trying to understand the why.

who’s fault is it? A little of everybody I guess. We all want good returns on our investments. This is how that happens.I'll give the "why" a shot based on my experience.

In the countless "corporate obedience training classes" I had to endure, I found the material excellent and presented in a way to change the "culture." In another class, 8 years prior, I was a part of a Six Sigma two year development project who's final thesis determined there was a "culture" problem. WTF?

Which really proved - management was inept. They were the culture. But that was not allowed to be the answer.

That's all a bunch of corporate bullshit peddled by corporate worms - because that's what they get paid to do, and it never changes shit.

It is all decided by bean counters and the next quarterly earnings report.

As Carlin said - they don't give a fuck about us.

-

3 hours ago, Tiger337 said:

Maybe, I just expect big corporations (whether it be the credit card company or Amazon) to find a way to screw me either way. Smaller companies are different. I am happy to get the rewards because if I don't, I suspect Amazon will find a way to to charge me more anyway. Maybe, I am just too cynical.

At the end of they the people who win are the swine bankers.

-

Speaking of dispensaries; thank you Michigan. Giggle.

-

1

1

-

-

4 hours ago, Tiger337 said:

Getting back to investing...I had two CDs mature yesterday, so I was eager to invest the money at great new rates and there is hardly anything available. I talked to a TIAA rep and he told me inventory is very low due to the hoilday. So, I'll try again next week. Patience.

Getting back to investing...

Treasury Direct still works. You can make 130 or so bucks a month on 40 grand, which is better than cash. 4 week T-bills.

-

1

1

-

-

-

1 hour ago, oblong said:

She’s just assuming the reason as fact when the data is not clear “on that”. People don’t want those jobs for the wages being offered and boomer/early retirement spurred it. Lifestyle changes as well. The need to blame people is enlightening to someone’s world view.

I hate using Tweets as data, but that built on my thesis. There are parts of our jobs data (certain industries) that are robust, and hiring, while others are not. First, you must sift through the reports (only the "headline" numbers are reported, but not necessarily a good indicator in the bigger picture, so you have to dig).

The data tells tales.

I don't want to get into a giant pissing match (not thinking you do either) but the automation angle is real. I've sat in the meetings figuring out how to eliminate jobs. Everything in large corporate America is all about the bottom line. Period.

I think you work for a large company, so you probably already know that.

-

1 minute ago, Deleterious said:

Our customers are a bit older. 35+ 40+ types. I bet you are right on the under 35 crowd. Wouldn't shock me if their credit/debit card use is over 95%.

That makes sense. Yea, the young people don't use cash.

-

8 minutes ago, ewsieg said:

Hey, be a good American and look the other way.

Well, it really doesn't matter anyway - nothing changes. I remember back in 1980 working for a large crane manufacturer. We sold stuff to the military. I remember $11 o-rings that I could buy at the local hardware store (we did) for less than a dime. So it's been a scam for at least 50 years.

-

4 minutes ago, Deleterious said:

Yep. All cards have different fees. A single company will have different fees based on which card you have. Just a straight up CC will have a lower transaction fee than a rewards card.

American Express has the highest fees. Visa, MC, and Discover all normally top out around 2.4% + 10 cents. American Express is something like 3.3% + 10 cents. Then each card has an assessment fee of .13-.15%.

A lot of the fees are based on volume. Walmart is charged a much lower fee since they do billions in transactions a year compared to us that will only do a few million. And the more volume you do the more negotiating power you have on fees.

Yeah, we could never go cash only. 80-85% of our sales are on credit/debit cards.

Excellent - thank you.

Makes sense on the volume thing, so I learned something new as well.

80-85% on cards. I would actually expect that to be higher. Which is why I think my buddy is nuts, but he's still open.

-

While I'm here; Exclusive: The Pentagon’s Massive Accounting Fraud Exposed - How US military spending keeps rising even as the Pentagon flunks its audit.

FTA:

QuoteOn November 15, Ernst & Young and other private firms that were hired to audit the Pentagon announced that they could not complete the job. Congress had ordered an independent audit of the Department of Defense, the government’s largest discretionary cost center—the Pentagon receives 54 cents out of every dollar in federal appropriations—after the Pentagon failed for decades to audit itself. The firms concluded, however, that the DoD’s financial records were riddled with so many bookkeeping deficiencies, irregularities, and errors that a reliable audit was simply impossible.

Color me not at all shocked.

-

14 minutes ago, Tiger337 said:

Great, Another bill to help mega-corporations and nobody else.

We have the best government money can buy. And our taxes even pay the useless pukes.

-

41 minutes ago, Deleterious said:

Rewards cards are giant scams. Huge shell game where the money always funnels back to the CC company.

Rewards cards charge the highest fees by far. We adjust our prices to meet those higher fees when we sell the public some goods. So now to get your cash back or travel points you are paying a higher price for the item you purchased. So it saves you nothing. Even though I am selling goods at a higher price, none of that is going into my pocket since I am just matching the higher interchange fees from the CC company. The only winner here is the CC companies.

Some isolated incidents you will come out ahead. Amex has a card with 6% back on groceries and streaming services. Consumers definitely come out ahead on those type of deals. But the 1%, 1.5% cash back deals, probably not.

I have been told that, depending on the card (Mastercard vs. Capital One for example) they charge different fees. Is that true (since I don't work in the retail space)?

Also, I have heard that Capital One charges the highest fees, is that true? A local gas station has a sign telling the minimum amount you could put on a card. I think it is 5 bucks. People were using cards to buy a .75 cent coffee. I imagine they were losing money on the transaction, but I don't know what the fees are. I don't blame them.

I have been in places that have a "cash" price and a "credit" price. I think that would be a good idea. I have a buddy who owns a restaurant, and he won't accept any cards. I think that is a really stupid idea. Seems like you are really limiting your potential clientele. But, it's his place so he can do what he wants.

-

-

How Did Covid Impact the Minimum Wage Someone Would Accept for a Job?

Payrolls vs Employment Since March 2022

- Nonfarm Payrolls: +2,692,000

- Employment Level: +12,000

- Full Time Employment: -398,000

Employment fell by 138,000 in November.

Full time employment is down 398,000 since March and down by 480,000 since May!

For the latest jobs report, please see Another Strong Jobs Report? Phooey, and I Can Prove It

Please note The Philadelphia Fed Just Revised Jobs Lower by 1.2 Million for Q2

QuoteIn the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period. Payroll jobs in the nation remained essentially flat from March through June 2022 after adjusting for QCEW data.

-

1

1

POLITICS SCHMALITICS

in Politics

Posted

I can't speak for everywhere, but the educational system around here is a complete mess. I don't know what my college does for financial stuff, but the high school kids I had for 3 years were clueless, and I'll go on record the lock downs and zoom meetings during COVID didn't help one bit.

I had some down time one day waiting on a kid to come back from a trip to the office. I asked the kids if they knew how to make change - not a clue (this was a STEM class with a room full of so-called wannabe machinists). They didn't have much of a clue for a lot of other things either. Now I think I am seeing these same things with the frosh in college. Last semester was one of the worse ones I've had.

I gave up the high school stuff because I was tired of playing Sister Mary Elephant.