Screwball

Members-

Posts

1,562 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Everything posted by Screwball

-

Another calendar thing that used to drive me nuts was the high school graduation stuff. Sunday, of Memorial Day weekend. The ceremony at noon. I get it, you have to have a commencement, but why then? Our little hick town school only graduated 40-50, but I guess that doesn't matter. I did it four times. I escaped high school long before that and only went to ceremony because mom would have kicked the living crap out of me if I didn't. BFD. That's what your suppose to do. Life will be calling, this is fantasy. Giddy up. It was also the same time as the Indy 500. Spit.

-

Weddings are nuts. I don't get it. When my oldest got married the brides family were - let's say skeptical - about our family of crazy people. We liked to party and have a good time, but they were not into that stuff. The were as squeaky clean as could be. The reception got a little wild once their side found out they couldn't handle the booze, dancing, and kick ass music. When we left, the maid of honor was sitting on the ground against a post right outside the front door where everybody left, after pissing herself (puddle running down the asphalt) while she held a beer asking someone to help her. I have fallen and I can't get up. People are so funny.

-

I'm only half joking, but doesn't anyone EVER look at a calendar when they plan that stuff? 🙂 I know, I know... I think it was 2012. The Tigers were in the playoffs and I had to go to a wedding. Girlfriends daughter was the MOO. She told me about it, and the first thing I checked was the game times. Sure enough, wedding was OK, but the reception was during the game. I couldn't get out of it. I warned her right up front - I WILL find a way to watch this game - just so you know. She was a Tiger fanatic so she was good with it. We get to the reception hall. Rectangle room with a partition toward one end. I went snooping behind the curtain and sure enough there was a bar and some tables back there. At the end of the bar was a TV. Oh, goody! So I wander in there expecting to get kicked out because the only people in there were the workers taking care of the food and drink for the wedding in the other room. Hi! I want to make you a deal. I really really need to watch the baseball game tonight, and if you can get that on for me you all will have a very nice night, if you know what I mean, as a threw a $20 bill on the bar. They were all for that, so I sit down at the end of the bar, they turned on the TV, and we were good. I kept tipping them all night as they brought me beers. Everything was cool, and we were having a ball. Until... IIRR, close game, maybe 8th inning some jerk and his wife comes wandering back there. Guy says to one of the workers "hey, there is a football game on." I says, no there isn't. Yes there is. Nope. Yea, channel X. Nope not happening. I was getting worried. This guy was getting pissed. One of the workers comes over and tells this guy "we are not allowed to change the TV on orders by the boss so it stays on the baseball game." Ha! Thank you very much as the guy left and I tossed another $10 bucks on the bar. Probably cost me 50 bucks to watch the game but I watched it. They lost... And the rest of the story. Everything got over and I was, lets say, a little tipsy. I then find out, of no surprise to me, the car we rode to the reception no longer had a driver (these were highly educated people - go figger). Shouldn't be a problem until they figured out it was a stick and nobody could drive it. Can you drive a stick? Why yes, yes I can, but I am also 3 sheets into the wind. Well you are the only one who can drive a stick and these 4 people need to be taken home - all over Columbus, Ohio - no less. Thanks assholes... I somehow made it. Don't ever ask me to a wedding again.

-

I was playing with my AI Aussie buddy tonight. I never expected this one; You can't do that. I got out and got back in and it was fine. Short break I guess. Too funny.

-

Holy hockey stick Batman! 6 month chart porn by day. Up over 11% today, .025 from the high at close.

-

-

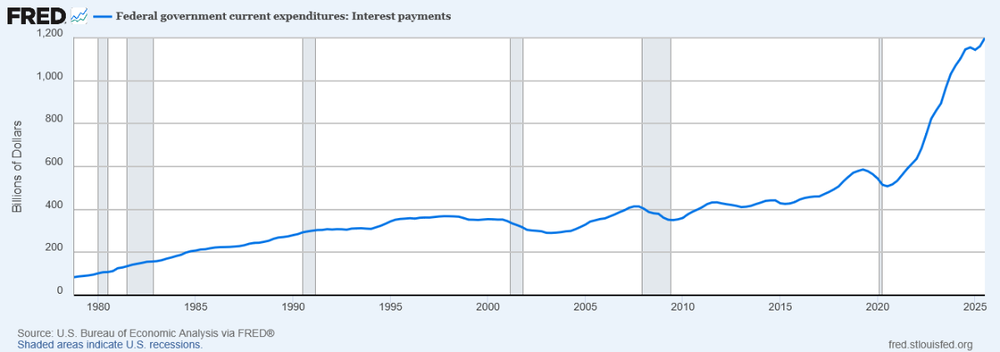

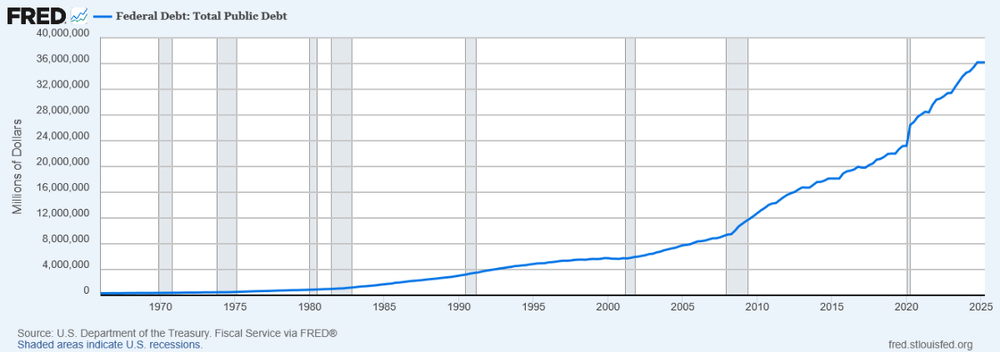

Debt, public or private, when interest is involved, turns into simple math. Exponents are a bitch.

-

Mooseheat - that's a name from the past. Years ago (many) a buddy of mine and his wife went to Mooseheart to visit someone or somebody, don't remember. It was there they ran into Art Carney of Honeymooners fame. He ended up at the same hotel and they sat in the room and drank and ate until 2 am. They said Carney was a hoot and a great guy. That had to be a ball.

-

This past summer a buddy of mine, to help conclude his bucket list, jumped out of an airplane. Small craft. He was attached to another guy who had the parachute and another guy who filmed it. Cost him $500 bucks.

-

I have seen pictures of that Grand Canyon glass bridge. I can't imagine!!! I think it would be a ball, but I just can't... Funny, the first time I flew was about a week after the 1982 crash in DC when the plane went in the river. Had to fly into the same airport. Oh goody! We know they are going to come down, that's a given. We don't always know how. And over the years my flying experiences have not been very good anyway. Then, you have people that jump out of them. Are you nuts?

-

I cannot imagine. I think it is all about how you deal with heights. Some people can, some can't. I'm a can't. I went to the top floor of the Sears Tower in Chicago, but was petrified. I guess now they have a transparent floor you can walk out on. The key word there would be 'you.' 🙂 I have a buddy who did a chopper ride over Hawaiian volcanoes , which I'm sure was spectacular, and memories of a lifetime. No way I could do that. I did have to fly for work, but I hated it. Always bought aisle seats. I had seats at a Tiger game one time in row 2 of the second deck right behind home plate and almost had crawl down the aisle.

-

I used to get some of those twin prop amusement park rides from Detroit to Toledo. Wasn't my money, so I booked it that way. They were wild. I was scared ****less, but I didn't like planes anyway. I figured it was worth it. I could be sitting at a bar three blocks from home after spending a week at an ass kissing extravaganza. 3 hours if I had to drive, not counting getting out of DET. Half hour joy ride saved me two hours. I would no way, no how, get in an airplane today, maybe not even drive under one if I can help it. 🙂

-

I don't know the details of this yet, but he was a pilot. I don't remember when it was but when NC got flooded he took his own helicopter to help people who were stranded. Sad story, seemed like a great guy. How former NASCAR driver Greg Biffle helped Hurricane Helene victims

-

That has been going on for quite some time. I can only imagine how far it has come today (I've been retired for over 6 years). If you can automate a process and eliminate people, they will. I'll give you a couple of examples. 1) I worked for a tire company. I was in the mold division. We made the tire molds that made the tires. They were made out of aluminum (sometimes steel but those were different animals). Our raw material was a big round piece of aluminum. It was a large ring. It would come in on a truck and the shop guys would mount it on a large plate. From there it was turned, shaped, and machined with boring machines and 5 axis CNC machines. Once mounted to the plate it was never touched again by human hands until the final assembly and placed in a shipping box. This was going on in the early 2000s. 2) Assembly plant. This one happened to be washing machines. This is where the automation really pays off. Any repetitive task is target for automation, robots, whatever. They have X amount of assembly lines with workers adding parts at various stations along the line that might be a quarter of a mile long (or longer). The parts come from a warehouse on little trains pulled by a little truck like vehicle. The truck would pull 4 or 5 wagons behind it full of parts. They would go from the warehouse to the proper line, and proper line station, get emptied by a person, then return for more parts at the warehouse. This went on all day every day. There were dozens of these things all over the plant. They were driven by a person. Not anymore. They put something in the floor so the train could follow because they put sensors under the train. The sensors followed the path in the floor. The slowed them way down for safety. You could walk faster than the train but they never stopped except when unloaded and loaded. This eliminated every train driver for each train for each shift (3 a day 7 days a week). This was over 10 years ago. That was by far not the only push for automation. Anything and everything that could be automated will be automated, period. The rest of the story, and kind of funny. The workers could see the future and what this automation/robotic push was going to do. So the natural thing for them, and maybe the only way to fight back, was to sabotage the automation. By accident, they found out a simple bag of potato chips could stop a train. Turns out, a bag of chips bought out of the vending machine had a reflective (silver looking) inside. Guessing it was to help keep light out of the bag. An empty bag of chips with the bag fully open sitting in the aisle where the train ran would make it stop. The reflecting bag messed up the optics of the robot sensor and it would stop dead in the aisle. They would have to call maintenance or someone to come fix it and send the little guy on it's way again. In that world the LAST thing you want to do it stop the line. One day I was there and the process guy told me they had to tell the vending machine people to remove all the potato chips from the vending machines because it was causing too many line shutdowns. Too funny - take that automation.

-

Maybe they should learn to count. 🙂

-

Yea, let's take a peek a some of them. First ORCL How about NVDA The MAGS ETF is holding up, but a big red candle today; They are suppose to go from the bottom left to the top right...

-

They piss away enough money each and every year - and have done so my entire lifetime - to give we the people the same health"care" as these worthless pukes who inhabit DC are fortunate to have. The money we pay on the interest on our debt alone would do wonders... Money is fungible, so just an example. Anyone who thinks these worthless ****s are going to fix this cluster **** (of their own making) has their head firmly stuffed up their ass.

-

How about some chart porn. First the S&P. Since the recent highs from interest rate euphoria the S&P is now back inside that long candle from back on October 10. Yellow arrow are the rate cuts. And then there is this one - Silver. The June 24th bubble at $35.195 to today at $67.18. What a ride! That's almost a double in 7 months.

-

A fine line between a genius and an idiot... If Space X IPO's at some point, he might be our first trillionaire.

-

I plugged the exact same string into Google's Gemini and got this: Just for fun, I did it again; Not good.

-

Venezuela is all about oil. Simple as that. That's been the plan since we needed oil. Also why the POS Marco Rubio was confirmed 99-0 as the person to make that happen. For every unit of growth, it takes a unit of energy. And now we have all these data centers!!! Git-r-done! No energy, no growth. Physics can be a bitch.

-

Funny, from that EIA report: I had a little AI conversation with my Aussie buddy. What kind of numbers are we talking about. Somewhere between .6 to 2.3 percent of US annual usage according to that EIA report. How much is that and what does it to? That sounds nuts, but that's what it says.

-

EV investments. Needs infrastructure to scale. Don't forget the crypto mining uses uses lots one may never consider. Add the data centers and the demand that comes along with them. Remember the "going green" push to use renewables and new tech for power? How long will it take to scale, if it can? Tracking electricity consumption from U.S. cryptocurrency mining operations - from the eia.gov How Much Additional Power Will Data Centers Need by 2035? Crypto is a small percentage but I would guess location may matter for a grid.

-

The company mentioned in the article above is CoreWeave who IPOed in March. Ticker Symbol CRWV if you want to have some fun. It has, as the article stated, almost doubled this year, but it did take a 10% hit on Friday. Somebody with brass balls can trade that prick, I want nothing to do with it.

-

Good article. Couple of things that caught my eye; You don't say! No, tell me it ain't so. If it brings down major banks and insurers we know what happens next. We have already watched that movie and it's not pretty.